California Estimated Tax Worksheet 2024. Every year, estimated tax payment deadlines fall on or around the 15th of april, june, september, and january, with small variations due to federal holidays and. The california state tax calculator (cas tax calculator) uses the latest federal tax tables and state tax tables for 2024/25.

(note that the fourth quarter deadline is in the. Use our income tax calculator to find out what your take home pay will be in california for the tax year.

* Required Field California Taxable Income Enter Line 19 Of 2023 Form 540 Or Form 540Nr.

Version 1.0, 11/29/2023, includes spreadsheets for california and federal.

You Want To Make Sure You Have The Right Amount Of Income Tax Withheld From Your Pay.

Enter your details to estimate your salary after tax.

Use This Webpage To Make Online Payments For Your Estimated Taxes, Using Your Bank Account Or Credit Card.

Images References :

Source: www.templateroller.com

Source: www.templateroller.com

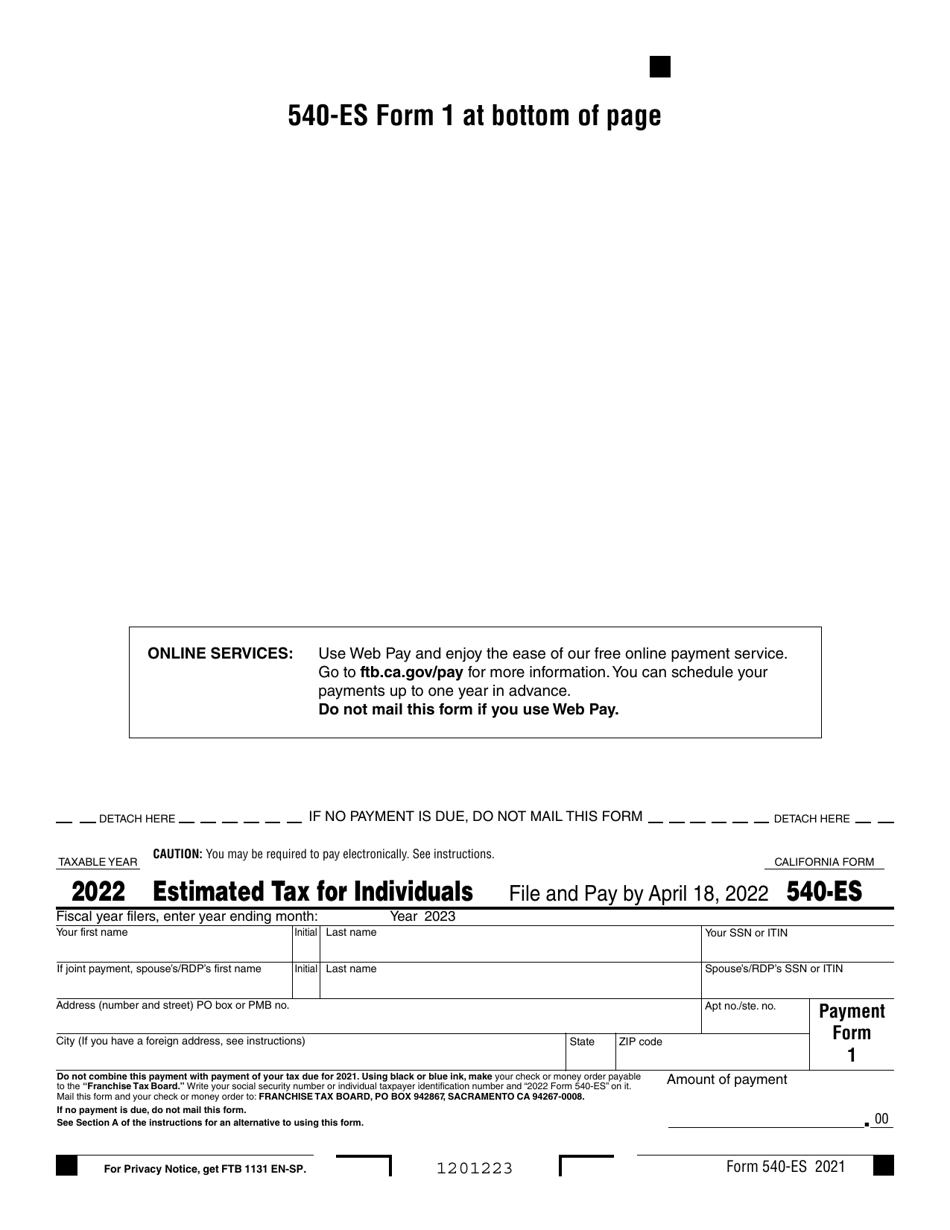

Form 540ES Download Fillable PDF or Fill Online Estimated Tax for, Estimated tax is used to pay not only income tax but self. Solved • by intuit • 4 • updated january 08, 2024.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Version 1.01, 12/21/2023, minor bug fix to the california sdi overpayment calculation. Use the 540 2ez tax.

De4 Worksheet A / California De4 V2 This Form Can Be Used To Manually, * required field california taxable income enter line 19 of 2023 form 540 or form 540nr. For 2023, your fourth quarter estimated payment is due january 16, 2024, and is 30% of your anticipated tax liability.

Source: worksheets.decoomo.com

Source: worksheets.decoomo.com

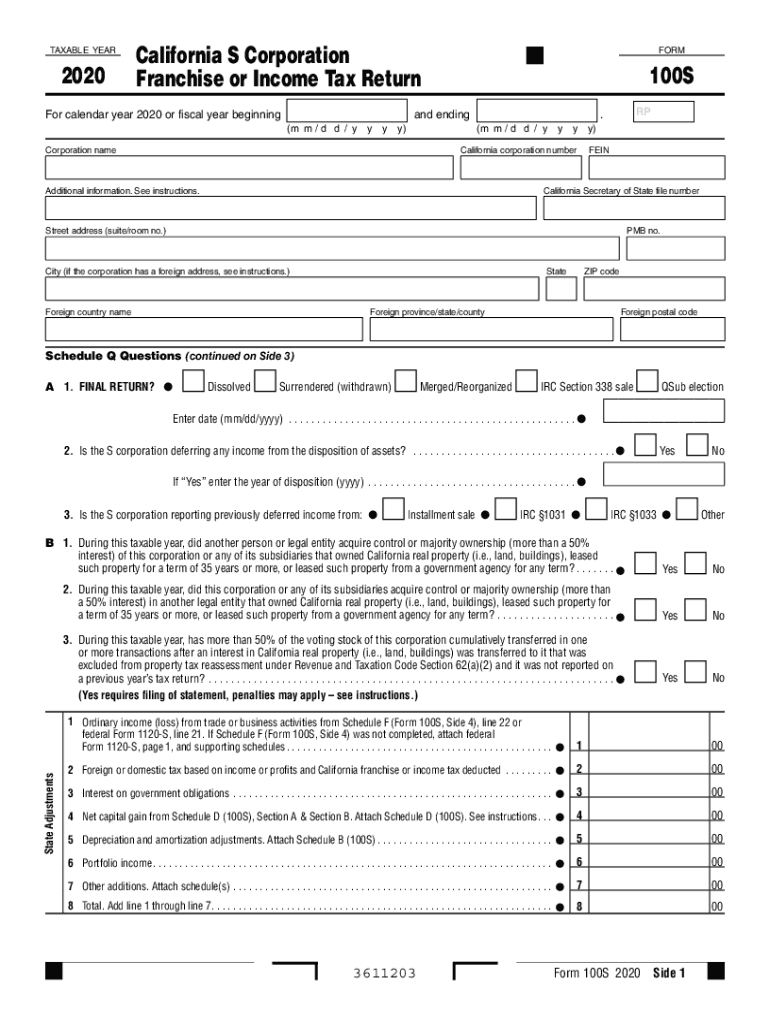

20++ Capital Gains Worksheet 2020 Worksheets Decoomo, Sch ca (540nr), part iv, line 5 california > estimates/underpayments: Use this webpage to make online payments for your estimated taxes, using your bank account or credit card.

Source: www.formsbank.com

Source: www.formsbank.com

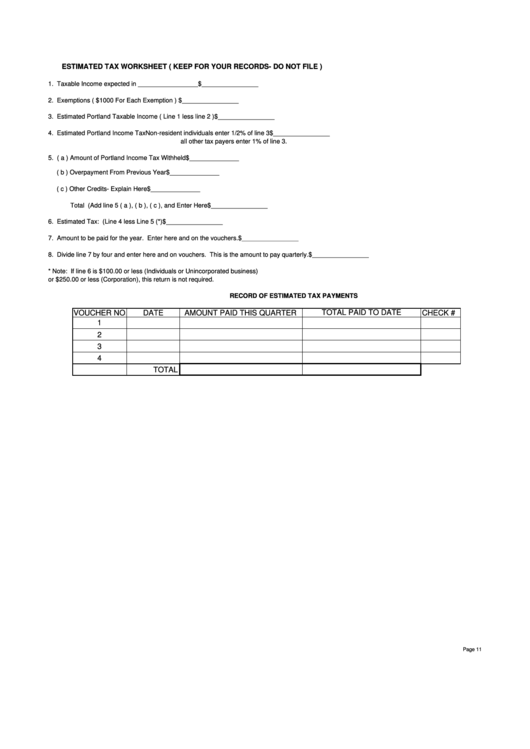

Estimated Tax Worksheet printable pdf download, Solved • by intuit • 4 • updated january 08, 2024. (note that the fourth quarter deadline is in the.

Source: classmediafloyd.z21.web.core.windows.net

Source: classmediafloyd.z21.web.core.windows.net

California Estimated Tax Worksheet 2022, The california franchise tax board. Use the 540 2ez tax.

Source: www.formsbank.com

Source: www.formsbank.com

Estimated Tax Worksheet printable pdf download, Every year, estimated tax payment deadlines fall on or around the 15th of april, june, september, and january, with small variations due to federal holidays and. Use the 540 2ez tax.

Source: byveera.blogspot.com

Source: byveera.blogspot.com

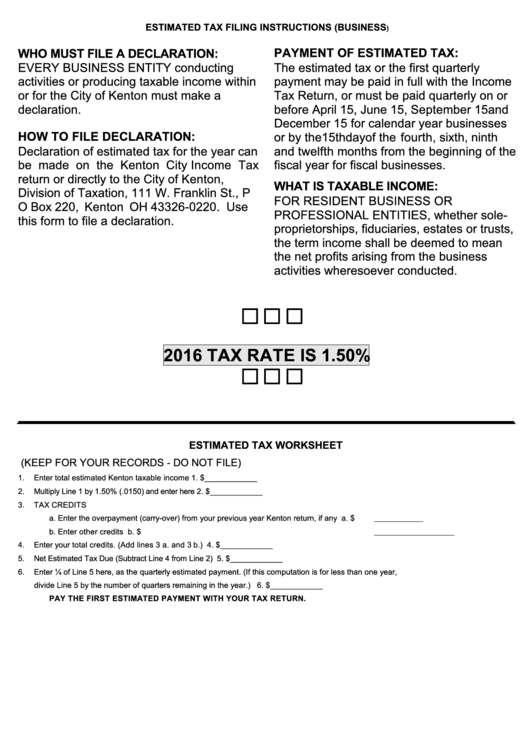

Annualized Estimated Tax Worksheet Worksheet Template Tips And Reviews, Solved•by turbotax•2193•updated january 30, 2024. Use this webpage to make online payments for your estimated taxes, using your bank account or credit card.

Source: materialfullurner.z19.web.core.windows.net

Source: materialfullurner.z19.web.core.windows.net

California Earned Tax Credit Worksheet, Sch ca (540nr), part iv, line 5 california > estimates/underpayments: To determine the amount of quarterly estimated tax payments, taxpayers can use one of two methods:

Source: worksheets.decoomo.com

Source: worksheets.decoomo.com

10++ Estimated Tax Worksheet Worksheets Decoomo, Common questions about california estimated tax in lacerte. Sch ca (540nr), part iv, line 5 california > estimates/underpayments:

Solved • By Intuit • 4 • Updated January 08, 2024.

Version 1.01, 12/21/2023, minor bug fix to the california sdi overpayment calculation.

(Note That The Fourth Quarter Deadline Is In The.

For 2023, your fourth quarter estimated payment is due january 16, 2024, and is 30% of your anticipated tax liability.